Markets are on edge ahead of Trump’s Fed chair announcement, with Kevin Warsh emerging as the frontrunner and betting odds shifting sharply in his favour.

Summary

-

President Donald Trump said he will announce his pick for the next Federal Reserve chair on the morning of Friday, January 30.

-

Former Fed governor Kevin Warsh is increasingly seen as the frontrunner following a reported meeting with Trump.

-

Betting markets, including Kalsi, have moved to reflect rising probability of a Warsh appointment.

-

Reports suggest Kevin Hassett is no longer in contention, while Rick Rieder remains a finalist.

-

Markets are bracing for potential implications for Fed independence, policy credibility and the rates outlook.

Markets are bracing for a major policy signal after President Donald Trump said he will announce his choice for the next Federal Reserve chair on Friday morning, January 30. The announcement comes amid rising speculation that Kevin Warsh has emerged as the leading candidate.

Attention intensified after a report from Washington-based journalist Rachel Bade indicated that Trump met with two finalists for the role earlier this week and is now leaning toward Warsh to replace Jerome Powell. While the report stressed that no decision has been made official, a source close to Trump was cited as saying Warsh has effectively received the “wink and the nod.”

Betting markets have reacted swiftly. Warsh’s implied probability on Kalsi has risen following the report, reflecting growing market conviction that he is now the most likely pick. Such moves are being closely watched by investors as informal barometers of political momentum ahead of the formal announcement.

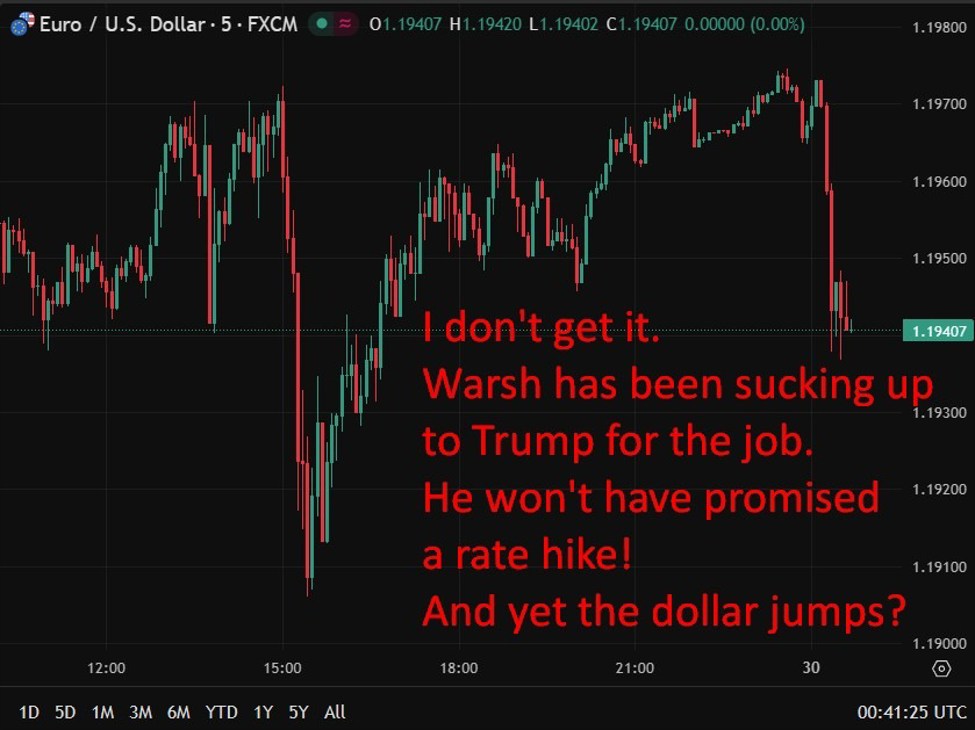

Warsh is a former Fed governor and long-time critic of ultra-loose monetary policy (in his honest, pre suck hole, days). Based on his considered comments before begging Trump for the Fed Chair job, he was widely viewed as more hawkish than Powell, particularly on inflation credibility and balance sheet policy. His potential appointment has therefore sparked debate over whether a Warsh-led Federal Reserve would prioritise tighter financial conditions or move more aggressively to reassert policy discipline. I dunno, if he is favoured it must be because he is willing to bend over to Trump and slash rates? That would be my take. The USD seems to think otherwise at present, its higher.

The report suggested Kevin Hassett is no longer in contention, while Rick Rieder remains the other finalist and was also seen at the White House.

With inflation still above target and markets sensitive to any signal of political influence over monetary policy, a shift in Fed leadership could carry immediate implications for Treasury yields, the US dollar and risk sentiment.

While confirmation awaits Friday’s announcement, the rising odds attached to Warsh underscore how seriously markets are taking the prospect of a change in direction at the top of the Federal Reserve.

Kevin Warsh

Leave a Reply