- RBI holds rates at 5.25% as inflation stays low and growth outlook remains steady

- Reserve Bank of India unchanged, as widely expected

- Reserve Bank India monetary policy decision due 10am local (0430 GMT/2330 US Eastern time)

- Recap: BoJ policymaker flags need for further hikes as inflation nears target

- India eyes up to $80bn in Boeing orders after US trade deal, CNBC reports

- Japan megabanks signal return to JGB buying as yields rise and markets stabilise

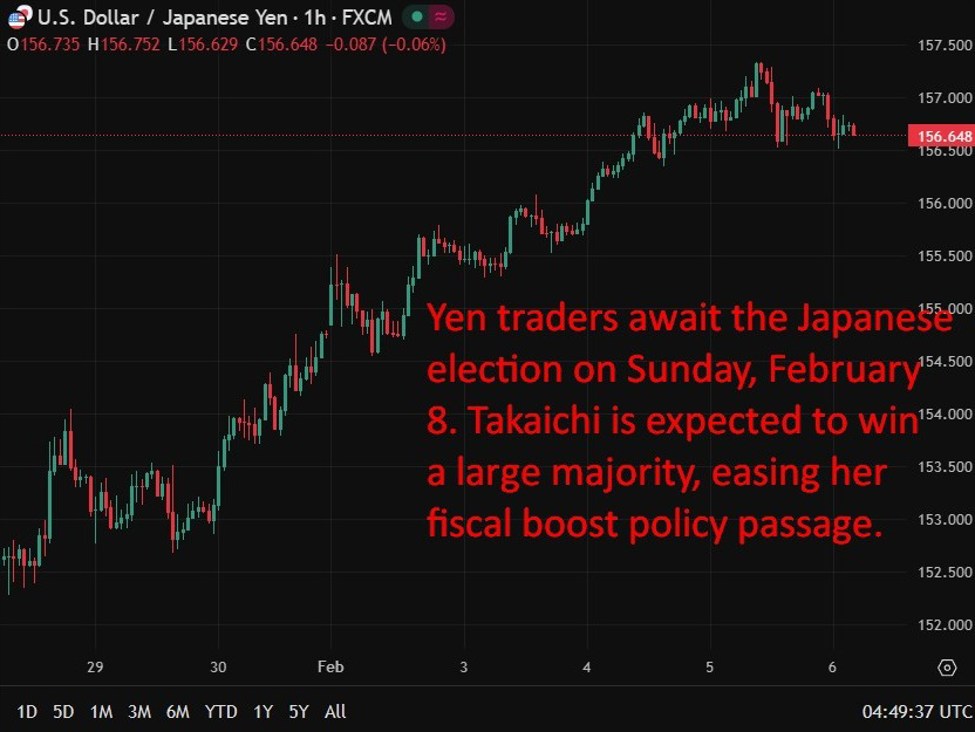

- Japan election Sunday puts yen and bond markets on alert as Takaichi seeks strong mandate

- Bitcoin, Ether bounce in Asia, swings continue

- US “leave Iran now” warning resurfaces, but advisory dates back to January

- BoJ’s Masu says Japan has shifted into inflation as policy normalisation continues

- Gold ETF inflows hit record in January as holdings and AUM reach new highs, WGC says

- PBOC sets USD/ CNY reference rate for today at 6.9590 (vs. estimate at 6.9517)

- South Korea sells $3bn FX stabilisation bonds to bolster reserves as won pressure persists

- Japan household spending slumps in December as inflation squeezes consumers (more)

- Gold is seeing selling in early Asia

- Japan December household spending falls m/m and y/y, poor numbers

- Russian oil discounts to China hit record as India demand risks mount

- Bullock says RBA needs tighter policy as capacity constraints lift inflation risks

- Gold fundamentals remain supportive despite recent correction, analysts say

- More on CME raises margins on COMEX gold and silver futures after extreme volatility

- CME raises margins on Comex gold (again)

- investingLive Americas market news: Bitcoin cut in half in four months, down 13% today

- Amazon Q4 2026 Earnings: Revenue Tops Estimates, AWS Drives Strong Growth, Small EPS Miss

At a glance:

-

Amazon shares slumped after earnings, as a heavy capex outlook overshadowed solid operating performance and strong AWS growth.

-

CME raised margin requirements for gold and silver futures following extreme volatility, triggering early Asia weakness before a partial rebound.

-

RBA Governor Bullock defended this week’s rate hike, flagging capacity constraints and persistent inflation risks.

-

BoJ board member Masu struck a cautious-hawkish tone, keeping further tightening on the table while warning about yen-driven inflation.

-

India’s RBI held rates at 5.25%, with the rupee little changed, while Japan’s election looms as a fresh risk for yen and JGBs.

Amazon’s Q4 2026 earnings were mixed but solid, with a slight EPS miss offset by a clear top-line beat. Operating income of $24.98bn and an 11.7% margin were effectively in line with expectations, signalling continued cost discipline. AWS was the standout, delivering $35.58bn in revenue and 24% ex-FX growth, well above the 21% expected.

However, the capex outlook dominated the reaction. Amazon flagged around $200bn of capex for 2026, far above the $146bn consensus, reigniting concerns around cash flow and near-term returns. The initial reaction was brutal, with chatter that the stock would be “slaughtered”, and Amazon shares were down more than 10% in after-hours trade at last check. US equity index futures also slid on Globex, though they later recovered off the lows.

In commodities, the CME again lifted margin requirements for key precious metals contracts. Initial margin on COMEX 100 gold futures rises to 9% from 8%, while COMEX 5000 silver margins increase to 18% from 15%. The move follows violent recent price swings and forced deleveraging across metals. Gold and silver fell in early Asia trade before stabilising.

In Australia, RBA Governor Bullock told parliament the board lifted the cash rate because the economy is more capacity constrained than previously judged, requiring tighter policy. She said demand growth must slow unless supply-side capacity and productivity improve, adding that the labour market remains strong, inflation is still elevated, and risks are skewed toward inflation persistence. The Australian dollar traded in a narrow range, briefly dipping below 0.6910 before edging back toward 0.6950, mirroring subdued moves across major FX.

In Japan, BoJ board member Masu said the central bank has exited extraordinary easing and will continue to raise rates if the January outlook is realised, but cautiously, to avoid disrupting the wage–price cycle. He described yen weakness as a double-edged sword, supporting profits but adding to imported inflation, and stressed that excessive or disorderly currency moves are undesirable.

Elsewhere, India’s RBI held the repo rate at 5.25% in a unanimous vote, retaining a neutral stance amid low underlying inflation and steady growth. The rupee was little changed.

Finally, Japan heads into a national election on Sunday, with polls pointing to a strong mandate for Prime Minister Sanae Takaichi. While a decisive win could stabilise politics, markets remain focused on fiscal risks, particularly her proposed food sales tax suspension, with implications for JGBs and the yen firmly in view.

Asia-Pac

stocks:

- Japan

(Nikkei 225) +0.29% - Hong

Kong (Hang Seng) -1.13% - Shanghai

Composite +0.11% - Australia

(S&P/ASX 200) -2.26%

Leave a Reply