China’s January inflation data missed expectations and showed persistent producer-price deflation, reinforcing pressure for further policy support.

Summary:

China’s inflation data for January underscored persistent deflationary pressures in the world’s second-largest economy, with consumer prices rising less than expected and factory-gate prices remaining in contraction.

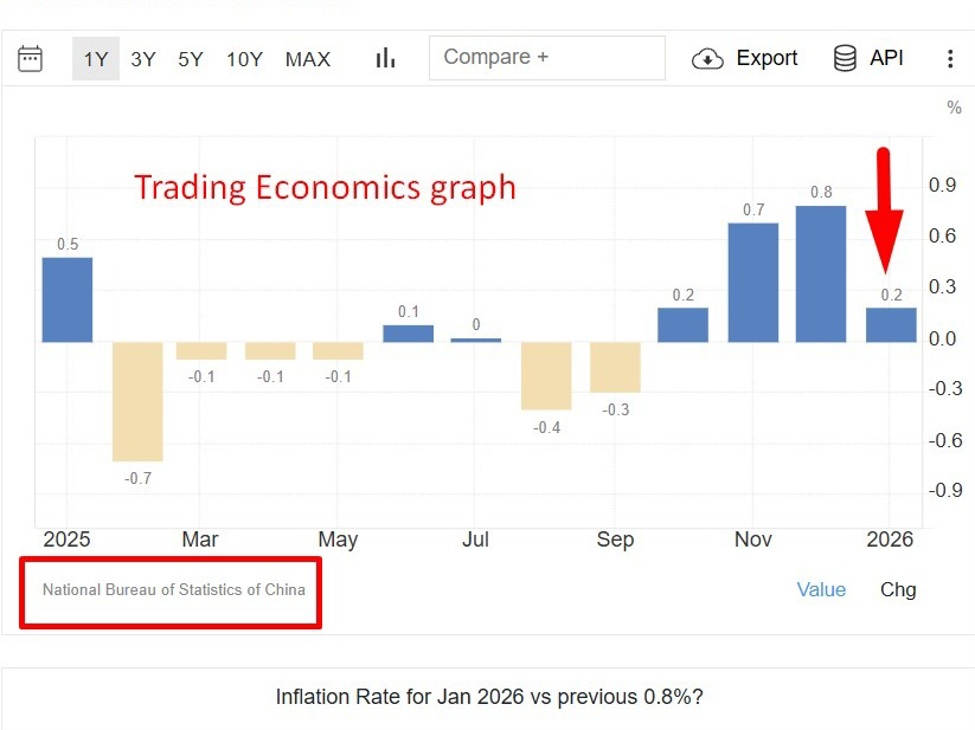

Data from the National Bureau of Statistics of China showed the consumer price index (CPI) rose 0.2% y/y, below expectations for a 0.4% increase and down from December’s 0.8% gain. On a monthly basis, prices also rose 0.2%, undershooting forecasts.

Core CPI, which excludes food and energy, increased 0.8% y/y, easing from 1.2% in December — a sign that underlying demand pressures remain soft.

Meanwhile, producer price index (PPI) data pointed to ongoing weakness at the factory gate. PPI fell 1.4% y/y, slightly better than expectations but extending a deflationary run that has now lasted more than three years. The persistent decline in producer prices continues to squeeze industrial profitability amid subdued domestic demand and lingering excess capacity.

China’s broader economic backdrop remains mixed. The economy expanded 5% in 2025, meeting the government’s target, supported by resilient exports to non-U.S. markets. However, authorities continue to grapple with property-sector weakness, fragile consumer confidence and overcapacity across key industries that has fuelled price competition.

Policymakers have signalled further support may be forthcoming. In its latest quarterly report, the People’s Bank of China reiterated its commitment to maintaining an “appropriately loose” monetary stance and guiding prices toward a more sustainable recovery.

With key annual policy meetings approaching next month, markets will watch closely for additional fiscal or monetary measures aimed at arresting deflationary pressures and stabilising growth.

Leave a Reply