UBS: SNB unlikely to resist franc strength; EUR/CHF seen at 0.95 in 12 months.

Summary:

-

UBS says SNB unlikely to react forcefully to recent franc rally.

-

Inflation outlook subdued but not deflationary, limiting case for rate cuts.

-

Sporadic FX intervention possible, but not a sustained defence.

-

German fiscal expansion seen supporting euro.

-

UBS forecasts EUR/CHF at 0.95 in 12 months.

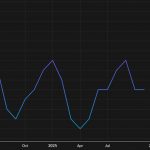

The Swiss National Bank is unlikely to mount an aggressive response to the franc’s recent appreciation, according to strategists at UBS Global Wealth Management, who argue that the currency’s strength does not yet justify forceful policy action.

In a note to clients, UBS said Switzerland’s inflation outlook remains subdued but not deflationary, reducing the urgency for interest-rate cuts. That distinction is key: while price pressures are soft, they are not collapsing, meaning the SNB does not face the kind of deflation risk that would typically warrant policy easing.

The bank sees scope for sporadic foreign exchange intervention, a familiar tool in the SNB’s playbook, but does not expect authorities to actively resist further franc gains. UBS contends that the currency’s overvaluation is not extreme and that deflation risks remain modest, giving policymakers room to tolerate some appreciation.

Instead of leaning heavily against the franc, the broader macro backdrop may do some of the work. UBS points to increased fiscal spending in Germany — Switzerland’s largest trading partner — as a supportive factor for euro-area growth. Stronger German demand could underpin the euro and naturally temper franc strength over time.

The key call is in the forecasts. UBS expects the euro to rise to 0.95 Swiss francs over the next 12 months, implying a gradual weakening of the franc from current levels rather than a renewed surge higher.

For markets, the message is that the SNB is unlikely to stand in the way of orderly currency moves, especially if inflation remains contained and external growth conditions improve. That leaves EUR/CHF direction increasingly tied to euro fundamentals rather than intervention risk.

Leave a Reply