- Doesn’t comment on meeting with Ueda or FX

- Hopes BOJ works closely with the government

- Wants to durably achieve 2% inflation target accompanied by wage grains

- No change to our stance to seek market confidence in Japan’s finances by achieving fiscal stability, stably lowering debt-to-GDP ratio

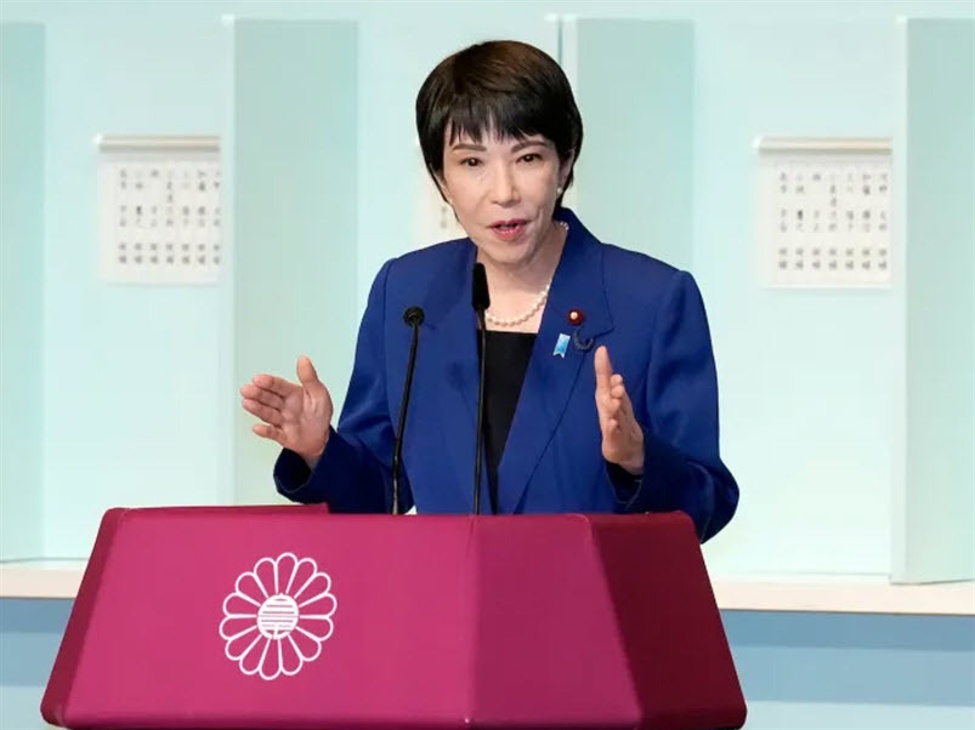

The start of this year looked like 2026 could be the year where Japan’s finances blew up but the super-majority for Takaichi has significantly calmed the markets and 30-year Japanese borrowing rates have reversed.

Japan 30 year yields

I maintain that this is one of those ‘boy who cried wolf’ trades where people have been anticipating trouble for 25 years. Once the trouble comes, it will be ignored for too long and by then it will be too late to stop it from spiralling.

That said, financial crisis’ often follow political ones and the supermajority for Takaichi ensures a period of political stability and a strong mandate to tackle structural issues in the economy and boost growth. That’s not the recipe for a collapse in Japanese bonds or the yen. Instead, we’ve seen USD/JPY fall sharply since the election coupled with a 7% rally in the Nikkei.

At the moment though, USD/JPY is near the highs of the day and threatening yesterday’s peak. It’s up 65 pips to 153.90 and threatening a retracement after the plunge from earlier in the month. There’s room for a further retracement here if US markets calm.

USD/JPY 1 hour

The latest move is part of a broad USD rally early in US trading. We saw big bids yesterday into the London fix so this could be a flow-driven carry over.

Leave a Reply