Goldman Sachs is now expecting that the Bank of England will cut rates by 25 basis points in December after their interest rate decision today. About today was 5 – 4 with the 4 dissenters arguing for a cut of 25 basis points.

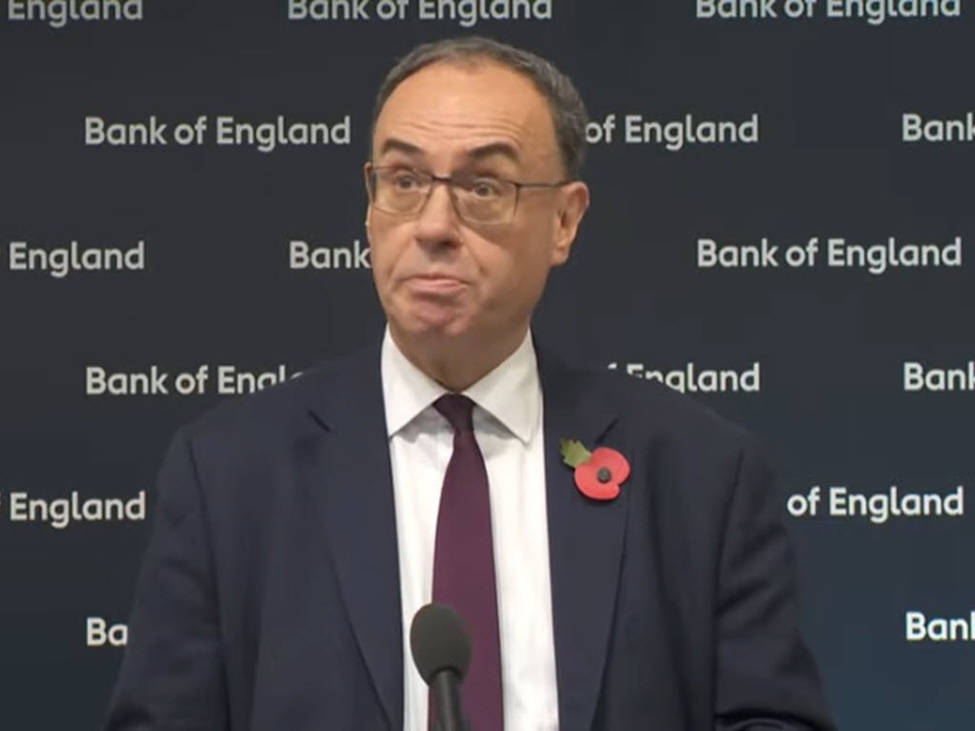

Governor Bailey signalled that the BoE is likely to follow a gradual downward path for rates, provided inflation continues to ease. He emphasised that the committee is not yet ready to cut rates because it wants to observe clearer evidence that inflation is on a sustained downward trajectory.

He noted that inflation remains “a long way above” the 2 % target, so the BoE must remain cautious about risks of persistence—particularly pay and price setting reversal or “second-round” effects from food and energy inflation.

At the same time, Bailey acknowledged that economic activity is weak—for example the labour market is showing signs of softening—and thus there are two opposing forces: sticky inflation on one hand, and weak demand on the other.

With Bailey siding with the “keep rates unchanged” he may once again be the deciding vote in December. The BOE meets again on December 18.

Leave a Reply