Markets:

- Gold up $63 to $5086

- US 10-year yields up 3.3 bps to 4.18%

- WTI crude oil up 89-cents to $64.85

- S&P 500 flat

- JPY leads, EUR lags

The super-strong non-farm payrolls report came as a big surprise. It was coupled with a drop in the unemployment rate and the initial market reaction was exactly what you would expect: Big USD bids. The euro fell to 1.1835 from 1.1900 in a straight line while USD/JPY jumped a full cent.

From there it splintered and part of that was skepticism that employment is actually re-accelerating. This jobs report came after five weaker employment numbers from various metrics. That’s tough to square but it also reflected another month of strong hiring in health and education.

Whether it was skepticism or something else, the US dollar lost ground on a few fronts, particularly USD/JPY which is undergoing a reset following the Japanese election. It fell to a low of 152.56 from as high as 154.60 — two full figures. The euro also rebounded close to 1.1900 and the Australian dollar rallied to a session high.

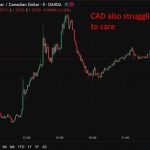

It was mixed elsewhere as cable stayed under pressure and the loonie was bounced around by a separate story saying Trump had mulled leaving USMCA. That left the Canadian dollar near the bottom of the FX pile today even as oil climbed and the antipodeans outperformed.

In equities, futures jumped on the NFP headline even as yields rose. However the optimism didn’t last as software stocks were hammered once again. There is a real flight out of US tech and I tend to think that’s keeping the dollar pinned, including on a day like today when it should have rallied strongly. The ‘old economy’ stocks continue to outperform as today saw Caterpillar up 4% and energy names broadly higher.

I worry that this dead-cat bounce in equities harkens for more pain.

Gold strengthened again today while silver rose to $84. Bitcoin fell 2% as it chops around $67K.

Leave a Reply