At a glance:

-

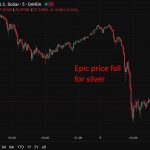

Precious metals were smashed in thin liquidity, with silver collapsing sharply

-

Gold slipped amid weak China demand data and broader risk aversion

-

Crypto sold off again, with Bitcoin breaking below US$71k

-

US equities fell on renewed AI disruption fears; oil whipsawed on Iran headlines

-

Alphabet earnings beat on revenue but heavy capex capped enthusiasm

-

Fed’s Cook reinforced a hawkish bias, pushing back against near-term rate cuts

-

AUD weakened with the USD bid; JPY softer on Japan election/fiscal fears

Precious metals were the standout movers during the session, and violently so, with prices plunging in what looked like a classic thin-liquidity air pocket. Silver was hit hardest, dropping around 15% in a matter of minutes. While there was some fundamental news around gold, the scale and speed of the move suggested positioning, fear and poor liquidity were the dominant drivers rather than a single data point.

On the news front, China’s gold consumption fell 3.57% in 2025 to just over 950 tonnes, according to the China Gold Association. At the same time, domestic gold output rose 1.09% year-on-year to 381.3 tonnes. The data added a mildly negative tone for gold, but did not fully explain the sharp sell-off.

Crypto assets also came under renewed pressure. Bitcoin slid back below US$71,000, extending a downtrend that has so far rewarded trend-followers, with little evidence yet of capitulation or a stabilising bid.

The lead into the Asia session was already fragile. US equities fell as investors fretted, again, that artificial intelligence could pose an existential threat to parts of the traditional software and services model. Oil prices were highly volatile, surging initially on reports that US–Iran talks might collapse, before giving back gains just as quickly after confirmation that talks will take place on Friday in Oman.

In earnings, Alphabet delivered a solid top-line performance for the December quarter. Revenue beat expectations on strength in Search, advertising and Cloud, although YouTube Ads slightly missed. Operating income fell marginally short as costs stayed elevated, and investors focused heavily on guidance showing 2026 capex jumping to US$175–185bn, well above consensus 9around $115bn). Shares swung after hours but ended net higher, with Piper Sandler and Oppenheimer both lifting price targets.

From central banks, Federal Reserve Board Governor Lisa Cook struck a firm tone, signalling little appetite for near-term rate cuts. She said inflation risks remain tilted to the upside, with progress back to the 2% target having stalled, reinforcing a cautious Fed stance.

In FX, the Australian dollar traded lower, largely reflecting broader US dollar strength rather than domestic data, Australia’s goods trade surplus widening in December. The New Zealand dollar, Canadian dollar, Swiss franc, pound and euro also weakened. The yen lost ground again, briefly trading above 157, as markets brace for a decisive election win by Prime Minister Sanae Takaichi and the prospect of looser fiscal policy.

In corporate news, the Financial Times reported that Nvidia’s planned sales of H200 AI chips to China remain under US national security review, nearly two months after exports were initially approved in principle.

Asia-Pac

stocks:

- Japan

(Nikkei 225) -0.97% - Hong

Kong (Hang Seng) -1.27% - Shanghai

Composite -1.03% - Australia

(S&P/ASX 200) -0.47%

Leave a Reply