White House economic advisor Kevin Hassett crossed a line today when he said the authors of a paper who said US companies were paying tariffs should be ‘disciplined’.

The paper in question concluded that 90% of the tariff burden is being shouldered domestically and he called the “the worst paper I’ve ever seen in the history of the Federal Reserve system.”

That paper was published Feb 12 and draws the same conclusion has a handful of other papers about the costs of tariffs.

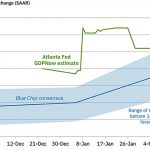

Now the NY Fed is out with another paper and he won’t like it either. The report aims to look through government shutdown effects on economic data collection and said “the aggregate trend for December stands at 2.83% , an increase from 2.55% in September.”

The report says:

Data releases for inflation have been scarce over the past four months

due to the government shutdown. As a result, until January 22 no

personal consumer expenditures (PCE) data were available beyond

September and the consumer price index (CPI) had many missing entries

for the one-month changes for October and November. In this post, we use

an extended version of the New York Fed’s Multivariate Core Trend (MCT)

inflation model to examine changes in underlying inflation over this

period. The MCT model is well-suited to do so because it decomposes

sectoral inflation rates into a trend (“persistent”) and a transitory

component. In contrast to core (ex-food and energy) inflation, its aim

is to remove all transitory factors, thus identifying the

underlying trend. In addition, since the model can handle missing

data—like for October—it can produce values for trend inflation for

months where little or no data were released.

The report cautions Fed officials on relying on disinflationary November data as when it’s aggregated with December numbers, there was a transitory effect.

Leave a Reply