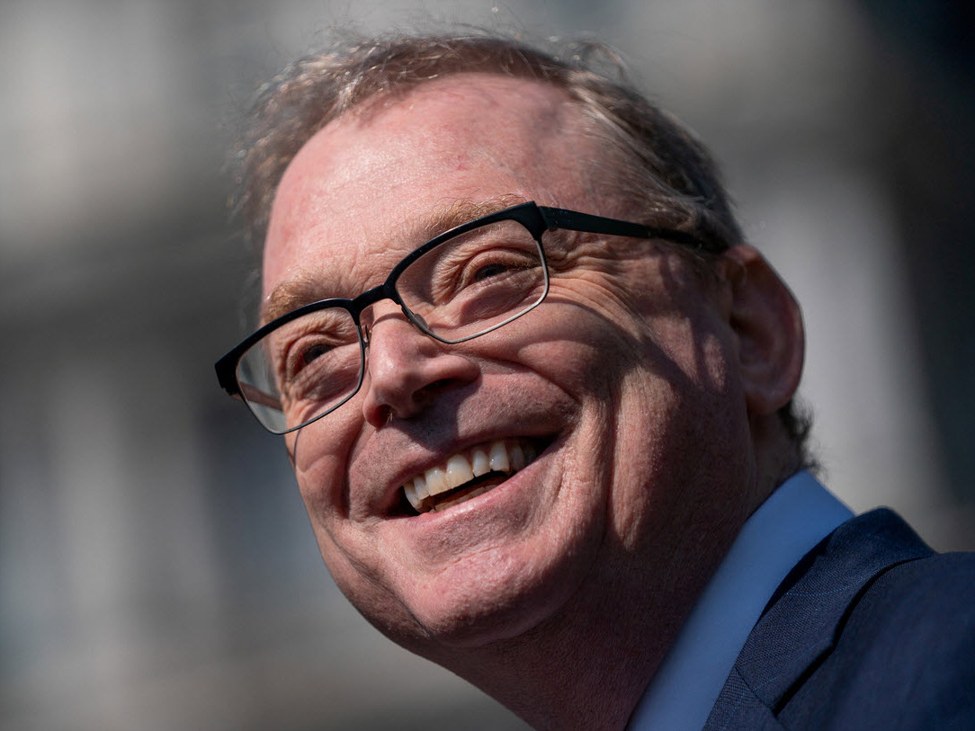

Summary of the comments from WH Economic Advisor Kevin Hassett:

NEC Director Kevin Hassett said there is plenty of room to cut interest rates, arguing that US rates are out of touch with the rest of the world, even as he described the underlying jobs trajectory as solid, noting recent data were distorted by the government shutdown. He said President Trump believes rates could be lower, but emphasized that any Fed action requires consensus built on facts and data. Hassett said deficit reduction is critical to lowering rates and expressed confidence the economy can return to 3% growth with 1% inflation, citing a productivity boom, particularly from AI-driven gains that are boosting worker productivity and wages. He was bullish on the labor market into 2026, argued that sustainable growth requires supply-side expansion north of 4%, and rejected the idea that the US is falling behind China, pointing to leadership in semiconductors, deregulation plans, and rapid progress in energy generation. On trade, Hassett said the administration is confident the Supreme Court will rule in its favor on tariffs, but noted Sections 232 and 301 remain available as backstops if needed. He also said Trump will announce a Fed chair nominee soon and expressed confidence there will never be another government shutdown.

Headlines from the White House economic advisor Kevin Hassett’s interview on CNBC:

- There is plenty of room to cut rates

- US rates are out of touch with the rest of the world

- on the jobs data sees a solid upward trajectory.

- Trump thinks interest rates could be lower.

- If I were there, I’d have to negotiate with the rest of the committee.

- Fed would have to see what kind of consensus could be reached.

- Thinks we can reach 3% growth and 1% inflation again

- Deficit reduction is a key to the economy to lower rates.

- We are pretty positive that the Supreme Court will rule in our favor, and if not we have backup plans.

- We have deals 232s and 301s to use as a backstop for tariffs if the Supreme Court rules against the tariffs.

- If Trump has a good reason, and I agree with it, I will present it to the others at the Fed

- Need consensus based on facts, data.

- On jobs data, he is bullish on 2026

- The jobs data was colored by the governement shutdown.

- ON GDP growth, looking at supply side, need to have north of 4%

- On jobs, AI, seeing AI-trained workers have increased their productivity and wages.

- Does not think we are falling behind China.

- We have the best chips, plan to deregulate.

- We’re catching up fast on energy generation.

- Trump will announce the Fed chair nominee soon

- Productivity boom is coloring all the data.

- He is confident there will never be another shutdown.

Earlier today, the latest US jobs and retail sales data painted a mixed picture of the economy, shaped in part by distortions from the recent government shutdown. Nonfarm payrolls showed a decline in October followed by a rebound in November, making it difficult to gauge the true trend in hiring, while the unemployment rate moved up to 4.6% from 4.4% which could be a worry but keep the Fed on the downside tilt.

On the consumer side, October retail sales were flat at the headline level, but the control group rose a solid 0.8%, pointing to firmer underlying demand that feeds directly into GDP. Together, the reports suggest moderating but still resilient economic momentum, leaving markets data-dependent and keeping the focus on whether growth can remain supported without reigniting inflation pressures.

Hassett was the overwhelming favorite to be the next Fed chair a couple weeks ago. He has now been replaced as the favorite by Kevin Warsh according to Polymarket, but it is close at 45% to 42%.

For your guide:

- Section 301 and Section 232 are two US trade-law tools used to impose tariffs, but they serve different purposes and carry different market implications. Section 301 of the Trade Act of 1974 is aimed at addressing unfair foreign trade practices, such as intellectual property theft, forced technology transfers, or discriminatory policies. Under Section 301, the US Trade Representative (USTR) investigates whether another country’s practices are unreasonable or burden US commerce and, if so, can impose targeted tariffs, quotas, or other trade restrictions. These measures are often country-specific and product-specific, and they tend to be used as negotiating leverage in broader trade talks.

- Section 232 of the Trade Expansion Act of 1962, by contrast, is grounded in national security concerns. It allows the US Department of Commerce to investigate whether imports of certain goods—such as steel, aluminum, autos, or critical supply-chain items—threaten national security. If a risk is found, the president can impose tariffs or quotas regardless of country, making Section 232 actions broader and more structural. Markets typically view Section 232 tariffs as more persistent and harder to unwind, since they are justified on security grounds rather than trade imbalances.

For traders and markets, Section 301 tariffs are often seen as tactical and negotiable, while Section 232 tariffs are viewed as strategic and long-lasting. Both can affect inflation, supply chains, corporate margins, currencies, and risk sentiment, but Section 232 actions generally

Leave a Reply