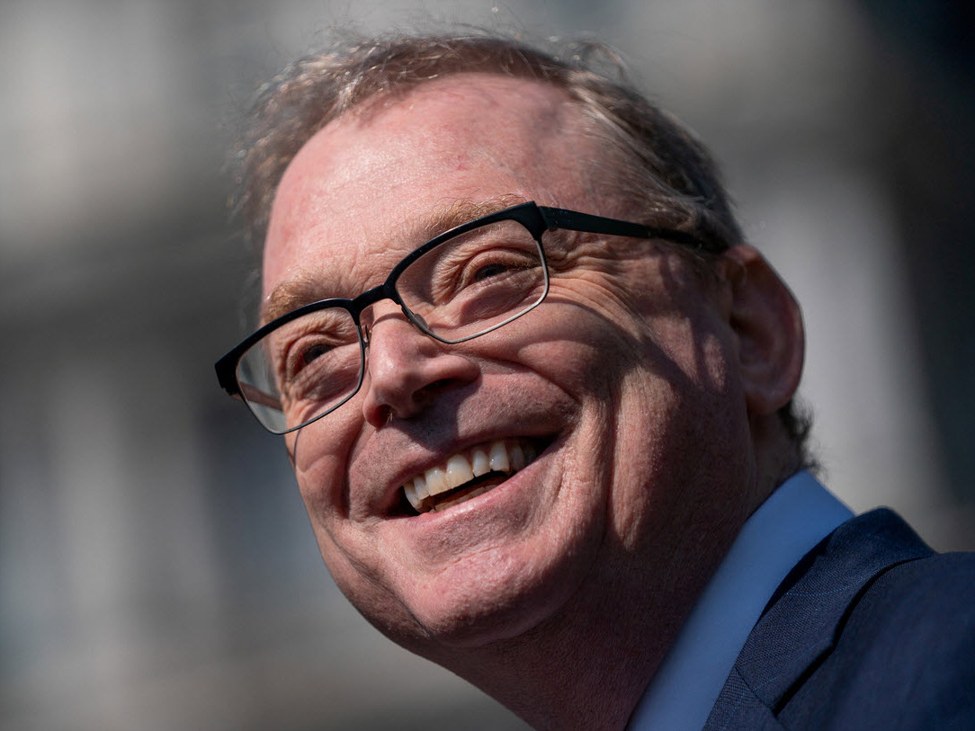

WH economic advisor Kevin Hassett Hassett:

- GDP is a great Christmas present for the American people

- Trump trade agenda is working

- AI boom is being seen in the data

- Regardless of job AI is impacting their job.

- Will see employment change back in the 100K -150K range if GDP stays in a 4% range

- Consumer sentiment is uncorrelated with the hard economic data.

- Prices are down and income is up that’s why we have such strong growth numbers.

- People are very optimistic about their income growth.

- The Fed is way behind the curve in lowering rates.

- We have reduced the deficit by 600 billion year-over-year.

- We will be finalizing a housing plan that will be announced sometime in the new year

Kevin Hassett remains one of the leading contenders to become the next Fed chair, with betting markets continuing to tilt in his favor. On Polymarket, Hassett is currently priced at 62%, well ahead of Kevin Warsh at 22%. While Warsh briefly overtook Hassett on December 16, market pricing has since reversed, suggesting renewed confidence that Hassett is the frontrunner as investors reassess both the policy backdrop and recent commentary from Fed officials.

Hassett’s appeal is rooted in his clear view that the Federal Reserve is well behind the curve in lowering interest rates. He has argued that restrictive policy risks overtightening the economy as inflation pressures ease, and that rates should be adjusted lower to better align with underlying economic conditions. If appointed chair, this philosophy would likely translate into a more openly dovish framing around policy decisions, even if the pace and timing of cuts remain conditional on incoming data.

That said, Fed policy is not set by the chair alone. Decisions are ultimately made by the full voting committee, which includes the Board of Governors and four regional Fed presidents. At the most recent meeting, the rate decision passed by a 9–3 margin, highlighting the range of views within the committee. Stephen Miran dissented in favor of a 50 basis point cut, while Austan Goolsbee and Jeff Schmid voted for no change, preferring to wait for additional confirmation that inflation is sustainably moving lower.

Since that meeting, the tone from at least one of those dissenters has begun to soften. Following the latest CPI release, which came in below expectations, Goolsbee has highlighted the encouraging disinflation signals in the data. While he has not walked back his prior vote, he has said that if the trend continues, it could support further rate cuts in 2026. Importantly, he continues to emphasize data dependence, underscoring that one report alone is not sufficient to justify an immediate shift in policy.

Taken together, the evolving inflation data and shifting rhetoric underscore why markets continue to focus on leadership at the Fed. Hassett’s growing odds reflect expectations for a more forceful push toward easier policy at the top, but the recent CPI data also suggest that the broader committee may be gradually moving in that direction on its own—albeit cautiously and at a measured pace as the Fed heads into the new year

Leave a Reply